Why (I Give to) United Way

Perry Atkins, Managing Director and Family Wealth Advisor with The Atkins Group, says that providing food is a particular passion for his family. He said United Way of King County’s work to ensure everyone has enough to eat helps fulfill that passion.

A former United Way fundraising cabinet member, Atkins added that he and his family support United Way of King County because it is “the best way to know who is doing the most effective social services in our community.” United Way’s efforts to fight hunger in our area include programs like Home Grocery Delivery, Breakfast After the Bell, and Free Summer Meals.

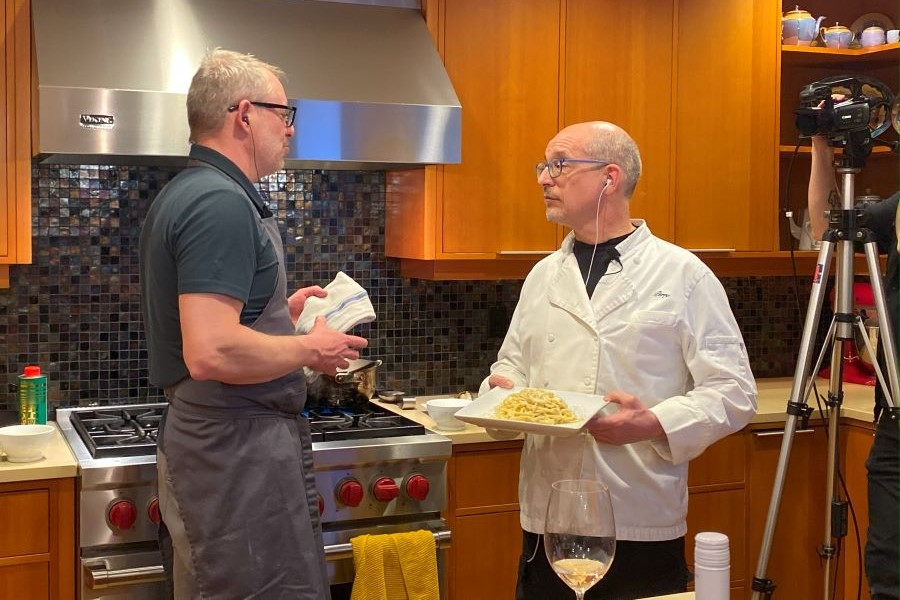

Atkins is also passionate about preparing and sharing food, as evidenced in the banner photo above.

That’s Atkins on the right, alongside restaurant owner Ethan Stowell, participating in a cooking class fundraiser for United Way. The fundraiser was held at Atkins’ home with 10 client couples on an interactive video feed.

He also encourages folks to support their favorite charities. Recently, Atkins conducted training for United Way staff on donor-advised funds, an approach to giving that is simple, impactful, and easy on the taxes.

According to Fidelity Charitable, a donor-advised fund (also known as a DAF) is a charitable giving account that allows individuals, families, or organizations to contribute assets (including cash or stock), receive an immediate tax deduction, and recommend grants to their favorite charities.

“DAFs have become the common and preeminent way of gifting for both the convenience and tax benefit as well as the benefit of supporting one’s favorite charities,” said Atkins, who was recently recognized as a 2025 Forbes Best-in-State Wealth Advisor. “You don’t need to be rich to use them, but they are particularly common in our area because of the affluence of our communities.”

Atkins said that DAFs are particularly beneficial in the King County community, given the many people here with highly appreciated stock. “It’s really special to this community, the extent to which that exists,” he said. “This is a really great way to be helpful, philanthropic, and tax-effective for yourself.”

By tax-effective, Atkins says, DAFs provide an immediate or current tax write-off with long-term benefits. “You get to have your cake and eat it too,” Atkins said. “I write it off today, but I don’t have to give it away today.”

To find out how you can support United Way via donor advised funds or other methods of giving, click here.

Comments