Let’s Help You Keep More of That Hard-Earned Money

If you make less than $80,000 a year (or less than $96,000 for non-single filers), we’ll do the work of preparing your taxes for free so you can get back more of your hard-earned money.

We help you understand your tax situation, plus take advantage of credits like the Earned Income Credit, Child Tax Credit, and the Working Families Tax Credit to maximize your refund. No fine print. No kidding.

We can file taxes back to 2020.

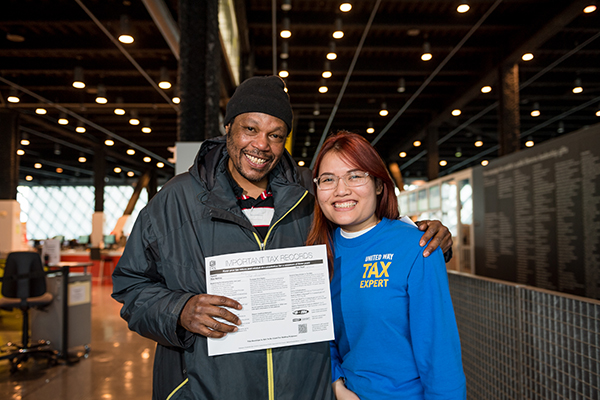

“I’ve been coming to this tax site maybe 15 years. I like it because it’s very convenient, people are friendly. I will help my family [with my refund].”

—Tessie

Proof of Identity is Required to File!

- Government-issued photo ID and proof of Social Security Number (or ITIN) is required to file.

- Photo ID: We must see government-issued photo ID for you and your spouse (if you are married). We cannot accept a copy or a picture.

- SSN: We accept the physical card, a copy of the card, or a picture of the card (such as on your phone). If you receive Social Security income, we can also accept an SSA-1099 as proof of SSN.

- ITIN: Please provide entire ITIN letter, either the physical letter or a photograph showing the complete ITIN letter (no partial picture).

- Proof of SSN and/or ITIN are required for everyone on your return, including dependents. Photo ID is only required for you and your spouse (if you are married).

- For more information on required tax documents, please review other items below.

Get Started

We’ve partnered with MyFreeTaxesWA to provide tax services statewide, helping you take control of your finances. Check our list of what to bring below to make sure you’re prepared.

In-Person Assistance

All our tax sites are first come, first serve. No appointments are necessary! Quickly confirm your eligibility to qualify for free tax filing.

Scroll down to see a map of all our tax sites!

Virtual Tax Assistance

Can’t make it to a tax site? No problem! Our virtual tax site can assist you from the comfort of your home.

Please note that you will need to feel comfortable speaking with tax preparers over the phone and submitting pictures of your documents, including your Social Security Card and Photo ID, for us to assist you. Access to a smart phone or computer is required for virtual tax assistance.

File Your Own Taxes—For Free!

Feeling good about filing your own taxes but want to do it for free, without any hidden fees? We’ve got you.

In-Person Tax Sites

Please click on the tax site schedule below for up-to-date information on site hours and closures.

Note that tax site hours have hard stops and will not stay open past closing hours. Please come in as close to opening as possible to have the best chance to receive assistance or arrive no later than 45 minutes before tax site closure. If you come later, you may need to return to the tax site at another time to finish your return.

Some tax sites offer language support. We have a full schedule of locations, dates, and hours sites are open and support is available.

ITIN Assistance & Renewels

Please review below where our ITIN services are offered in 2026.

Upcoming Free Tax Events

General Eligibility

Income eligibility for free tax assistance in 2026:

- Single filers who made $80,000 or less in 2025.

- Non-single filers who made $96,000 or less in 2025, including married couples filing their taxes jointly

Please note: The IRS does not allow our volunteers to prepare certain types of tax returns. We cannot prepare returns that include:

- Income earned outside Washington State

- Income from the sale of cryptocurrencies (you can own cryptocurrency, but we cannot prepare your return if you sold any in 2025)

- Most Schedule K-1 Forms.

We also cannot prepare returns for businesses with employees, businesses operating at a loss, businesses that wish to claim business use of the home, businesses with inventory (Cost of Goods Sold), and a few other situations.

What to Bring With You

Please make sure to bring the following with you to the tax site:

- If you are married, please bring your spouse.

- Photo ID.

- Social Security Card or ITIN for each person on your return (including dependents).

- Prior-year returns CANNOT be used to verify your SSN.

- Income documents (such as W-2, 1099s, Social Security income documents).

- Business expense documents, including mileage (if filing self-employment).

- If anyone in the household is insured through the WA HealthPlan Marketplace, please bring Form 1095-A. More information about 1095-A can be found here.

- Strongly recommended: Bank account and routing number for direct deposit. If you don’t have a bank account, resources are available at tax sites to help receive a direct deposit.

- Notice: If you were paid overtime or received tips, please bring your last paystub or other documentation for each job where you were paid overtime or received tips. If your employer voluntarily chose to report the amount of your tips in box 14 of your Form W-2 (or on a separate statement), you can use the amount reported to you.

Need to contact someone on the tax team?

Please email freetax@uwkc.org for any questions or concerns regarding our services. At this time, no phone assistance is available.

FAQ

United Way is an equal opportunity provider and anyone who earned less than $96,000 can use United Way’s Free Tax Preparation Campaign services. However, some returns are too complex for our volunteers. For example, we cannot prepare returns for income earned in other states or for returns that involve crypto currency.

Common Questions

What do I need to bring with me to a tax site in order to file my return?

- Both spouses (if filing jointly)

- Photo ID (and the spouse’s photo ID, if filing jointly)

- Social Security Card or ITIN for each person on return (including dependents)

- Income documents (W-2, 1099s, Social Security income documents)

- Business expense documentation (if filing self-employment)

- If anyone in the household is insured through the WA HealthPlan Marketplace, Form 1095-A and dependents’ proof of income. More information about 1095-A can be found here.

- Strongly recommended: Bank account and routing number for direct deposit. If you don’t have a bank account, resources are available at tax sites to help receive a direct deposit.

I don’t have my Social Security card. Can I still file with you?

Please note: Per IRS regulations, a return cannot be prepared without your SSN. Prior year tax returns do NOT satisfy document requirements. We will accept the following alternatives for your Social Security Card:

- Photocopy or photograph of Social Security card

- Social Security Benefit Statement (Form 1099-SSA)

- Military ID with Social Security number

- Any document issued by the Social Security Administration with the full SSN listed, including a printout from mySocialSecurity

Can I still use my prior-year tax return as proof of my Social Security number?

No. Unfortunately, the IRS has recently mandated that we stop using prior year returns to verify identity, even if the return was prepared by United Way of King County. We apologize for the inconvenience.

How is Free Tax Prep different from a paid preparer?

- There are many ways that Free Tax Help differs from a paid preparer. We invite you to come in person and see the difference for yourself!

- We save the average taxpayer an average of $250.

- All our volunteers are IRS-certified.

- Every completed tax return undergoes an extensive review process to ensure quality and accuracy.

- We will never offer predatory lending option such as “rapid refunds”

How is Free Tax Prep different from self-filing options, such as using TurboTax?

Our tax assistance options are geared toward folks who want help filing their returns or who would rather someone file for them. If you normally would file yourself online, without assistance, we don’t recommend you go to one of our sites. Instead, we recommend you use a free file service, such as MyFreeTaxes.com or the IRS Direct File tool.

What kind of returns can be prepared by United Way of King County?

Free Tax Help can handle most returns, including self-employment and for international students. However, some returns are considered out-of-scope, per IRS regulations. Returns with the following cannot be prepared at Free Tax Help sites.

- Cryptocurrency

- State tax returns

- Income/loss from rental property

- Sale or foreclosure of a house

- Active military pay

- Moving expenses

- Household employees

- Farm income/loss

- Credit from forms 4136, 2439, 8839 (adoption credit), 8801, 8885

- Bankruptcy

- Affordable Care Act: Parts IV (Shared Policy Allocation) and V (Alternative Calculation for Year of Marriage) of Form 8962

- The following types of business returns:

- Business expenses over $25,000

- Business showing a net loss

- Employee taxes

- Depreciation or amortization

- Inventory at year-end

- Business using accrual-based accounting

- Business use of home expenses

- Prior year disallowed passive activity loss

When should I file my tax return?

The official deadline to file taxes is April 19, 2026. However, if you were affected by the recent flooding, King County residents and business owners may be allowed to file taxes by May 1, 2026. However, waiting until the later due date is not recommended as the tax sites become very busy closer to due date.

I filed my taxes, but I still haven’t received my federal refund. What should I do?

Use the IRS’ Where’s My Refund? to check the status of your federal refund. To check, you will need your Social Security number or ITIN, your filing status (ex. single, married filing jointly, etc.), and your exact refund amount– the amount of money that your tax preparer or tax software told you to expect.

How do I protect myself from fraud?

- Unfortunately, scams can be common during tax season—but preparing yourself to recognize them and taking certain steps can reduce your risk. The website WalletHub compiled a helpful list of tips, starting with the two they deem most important: 1) File as early as possible every year, even if you don’t expect to owe any taxes or receive a refund; and 2) Take commonsense steps to safeguard your personal information, such as signing up for free 24/7 credit monitoring or putting a freeze on your credit.

- Read on for their other tips, such as ordering your tax transcript and improving your ability to recognize webpages that may not be secure or safe: Tax Scams & Tips for Avoiding Them

Is tax help available year-round?

United Way of King County tax sites will be open from January to April, with some sites expected to operate into the summer depending on service needs. We recommend that you plan to file during the tax season. However, if you anticipate needing assistance after the filing season, you may contact the Free Tax Team at freetax@uwkc.org.

How can I get copies of my tax returns from previous years?

If you are looking for a past Federal return, you can obtain prior-year tax return transcripts on the IRS Get Transcript webpage.

I received rental assistance from United Way, is that considered income for my tax situation?

You do not need to claim your rental assistance payment in your tax return.

I chose to mail my return and/or I had to amend my return and send it by mail and I haven’t heard back from the IRS yet. How can I find out what’s happening with my refund?

Unfortunately, United Way of King County does not have any way to check on a return’s status once it has been transmitted. Please contact the IRS with any questions you have about the status of your return.

I don’t know if I received my COVID stimulus checks. Is there a way to check if I received them and is it too late to claim this money?

Unfortunately it is now too late to claim the COVID Economic Impact Payments.

What is the Working Families Tax Credit (WFTC)?

The Washington Working Families Tax Credit (WFTC) is a new annual tax credit for Washington residents with low to moderate income, including undocumented people and mixed status families. The amount you can receive ranges from $50-$1,200, depending on your family size and income level.

Check your eligibility now through the Washington State Department of Revenue Working Families Tax Credit website.

Want more information about the Working Families Tax Credit? Please visit WATaxCredit.org.

Can I claim the Working Families Tax Credit at a United Way of King County tax site?

Yes, you can claim the Working Families Tax Credit at both our in-person and virtual tax sites.

I don’t live in King County. Can I still get help from United Way of King County’s tax prep services?

If you’re able to get to one of our sites in King County, we can help you in-person, or we can help you virtually on GetYourRefund.org. We do not require you to live within King County to receive assistance. Visit MyFreeTaxesWA.org for additional sites outside of the King County area.

However, please note that we cannot prepare out-of-state returns or state taxes. If you recently moved to Washington State and have to file state taxes with the state you moved from, we are not trained to prepare these types of returns. We can prepare your federal return and give you a recommendation on where to file your state return.

Are you able to look up my W-2?

Unfortunately, we are not able to look up income documents for you. If you do not have your income documents, please request an IRS transcript: https://www.irs.gov/individuals/get-transcript

Someone claimed my dependent even though they shouldn’t have. What do I do?

Unfortunately, United Way of King County cannot help with this. You will need to contact the IRS for resolution. However, we can help you prepare an amended return to submit to the IRS.

Common GetYourRefund.org Questions

How does GetYourRefund.org work?

GetYourRefund.org provides an easy way to virtually complete your taxes through a few easy steps:

- For free virtual tax preparation, click on “File with GetYourRefund”.

- Create a GetYourRefund profile, answer intake questions, and upload photos of your tax and ID documents. Please note that preparation cannot begin unless all required documents are uploaded.

After you’ve uploaded your documents:

- You will receive communication from one of our intake volunteers, who will go over your documents and make sure that everything is present.

- Once your documents are ready, you will pick an appointment slot to have your return prepared.

- One of our tax experts will complete your return.

- You will then sign your completed return.

How is GetYourRefund.org different from filing at an in-person tax site?

In a lot of ways, it isn’t different— a team of volunteers will be on the receiving end of your documents, who will help prepare your return and answer any questions you may have. However, there are a few things to consider if you wish to use our virtual tax services:

- You will need to submit very sensitive information, such as your Social Security Card, Photo ID, tax documents, and bank information (if you wish to direct deposit) through an online portal. If you do not feel comfortable sharing this information virtually, we recommend that you visit an in-person site.

- You will need to be comfortable taking clear, legible photographs of all your documents and be comfortable taking a picture of yourself. If you do not have access to a suitable camera (such as a smartphone camera) and/or a scanner, we recommend that you visit an in-person site.

- You must be comfortable navigating an online platform. Unfortunately, we do not have the staff to walk you through the process.

I uploaded my documents a long time ago, but I haven’t heard back. Where’s my refund?

GetYourRefund.org is not an automated process. A team of volunteers will be reviewing every document you upload by hand. Please enable text and/or email alerts (if you are able) and check your account frequently after you upload your documents to look for communication from our virtual volunteers. We cannot proceed to file your return without speaking to you and without obtaining your signature. Please allow at least 48 hours to hear back from a volunteer.

I don’t feel comfortable uploading my personal documents to your platform. Can I just show them to you over a live video?

Unfortunately, we are not able to do this, as we need to verify your documents before we can begin preparing your return. If you do not feel comfortable with uploading your sensitive information, please visit us at an in-person site.

How long does virtual tax preparation through GetYourRefund.org take?

We can’t guarantee how long a return will take, but if you upload all your required documents at once, we could have your return completed in as little as one or two days. The sooner we hear from you, the sooner we can get you your refund.

I don’t have all my documents yet. Should I start a profile on GetYourRefund.org?

Please do not create a profile and begin uploading your documents unless you have everything you need to file or will soon have everything you need and merely have some questions. We have limited availability on our online platform, so if we do not hear from you within a few days of opening your account, we will have to mark you as inactive (though your ticket will become active again once you upload another document or request for it to be activated again). We do this to ensure as many people as possible can access our online services.

Is there a deadline for virtual tax services?

All UWKC tax sites are scheduled to close by April 19, 2026 and will open again in late July. It’s strongly recommended you upload all your documents by the first week of April. If you upload in late April, your return may not be completed by the deadline. If you do not owe any money to the IRS, you can file over the summer. However, if you wish to file before the filing deadline, we strongly recommend that you upload all your documents by the first week of April. If you upload on the week of the deadline, please know that it is unlikely that we will be able to complete your return by the deadline. If you are not concerned about filing after the deadline (because you do not expect to owe money to the IRS and/or because you do not believe you will miss out on your refund from 2022), then you can expect to be able to file over the summer.

Do you have non-English support for virtual tax services?

We expect to have several volunteers who will be able to converse with you in Spanish. For other languages, we will have access to translation services. However, if you have someone whom you trust and who can help you translate, we recommend you include them in the process.

Can I file for someone else (such as a disabled or deceased relative)?

It’s possible. Please describe the situation in your intake document and inform the intake volunteer of your situation as soon as they contact you so we can determine how or if we can assist you.

Common MyFreeTaxes.com Questions

What is a simple return?

Simple tax returns covered my MyFreeTaxes include: W-2 Income, Limited Income interest, dividend income, student education expenses, unemployment income, student education credits, student loan interest, claiming the standard deduction, Earned Income Tax Credits, Child Tax Credit, and Child and dependent care expenses. A full list of forms included can be found here: MyFreeTaxes.com/Support

Are there any service limitations?

Many returns that are typically in-scope and free at our in-person tax sites, are not all included in the free software, for example, Self-Employment income (1099-MISC), Mortgage Interest, Real Estate Taxes, other Itemized Deductions, Third-Party Payments (1099-K), HSA, and many others. If you have these tax forms, you will have to purchase an upgrade to file with this system. However, you will receive a discount if using MyFreeTaxes.com. A full list of what is included in the free software can be found at MyFreeTaxes.com/Support

What do I need to file on MyFreeTaxes.com?

You will need:

- An email address to create an account

- Your exact AGI from line 11 on Form 1040 of your 2024 tax return (to verify identity)

- SSN for everyone on the return

- All tax documents

- Bank account and routing number (for direct deposit/debit)

I don’t know my 2024 AGI. What should I do?

You can find it on line 11 of your 2024 tax return if you still have a copy of your return. If you filed your taxes at a United Way of King County Free Tax Prep site last year, please email freetax@uwkc.org and include your phone number so we can provide you with a copy of last year’s return. If you did not file with us last year, IRS.gov/get-transcript can help you retrieve a copy of last year’s tax return.

Can someone with United Way of King County enter my information for me on MyFreeTaxes.com on my behalf?

Unfortunately, United Way of King County cannot enter your information and tax documents into MyFreeTaxes.com on your behalf. If you’re interested in having your taxes done virtually by our local Free Tax Preparation team, please use our GetYourRefund option.

ITIN Questions

What is an ITIN?

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number issued by the IRS for US residents, their spouses, and/or dependents who are not eligible to receive a Social Security Number.

What are ITINs used for?

ITINs are used only for the purpose of filing taxes. The IRS issues ITINs to enable US residents without a Social Security Number to file their taxes.

What documents do I need to bring with me to get my ITIN renewed with United Way?

You will need one document proving your foreign status, and one document proving your identity. Your passport is the best document you can bring, as it is proof of both your status and your identity. If you do not have a passport, please see below for a list of acceptable documents:

|

Document |

Foreign Status |

Identity |

|

National identification card (must show photo, name, current address, date of birth, and expiration date) |

✓ |

✓ |

|

U.S. driver’s license |

✓ |

|

|

Civil birth certificate (required for dependents under 18 years of age) |

✓ |

✓ |

|

Foreign driver’s license |

✓ |

|

|

U.S. state identification card |

✓ |

|

|

Foreign voter’s registration card |

✓ |

✓ |

|

U.S. military identification card |

✓ |

|

|

Foreign military identification card |

✓ |

✓ |

|

Visa |

✓ |

|

|

U.S. Citizenship and Immigration Services (USCIS) photo identification |

✓ |

|

|

Medical records (dependents only – under 6) |

✓ |

✓ |

|

School records (dependents only – under 14, under 18 if a student) |

✓ |

✓ |

Why should ITIN holders file their taxes?

Although unfortunately many tax credits are only available to individuals with Social Security Numbers, in interacting with the tax system, ITIN holders can receive their tax refunds and qualify for some tax credits. Additionally, ITIN holders must file their taxes to renew their ITIN.

How long does the process take?

After mailing the required documents, it typically takes 4-6 weeks for the IRS to create or renew an ITIN. However, sometimes it may take longer due to IRS delays.

How much does it cost to apply for or renew my ITIN with United Way?

Our ITIN renewal service is free.

Will there be non-English language support?

Many of our ITIN Certified Acceptance Agents speak Spanish or another language. We will also have translation services available, through LanguageLine.

I need my tax return to renew my ITIN. Can United Way help with both my tax filing and my ITIN on the same day?

Yes. However, if you would like to receive both tax prep help and ITIN assistance on the same day, please plan to arrive to your chosen tax site as early as possible.

Are you an international student or do you have an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number (SSN)?

We can help! Translation services will also be available if you need them.