Savings at Tax Time With myRA

Alysha Alani is an Emerson National Hunger Fellow at United Way of King County working to ensure that King County residents are able to weather financial shocks and can work towards long-term financial stability. She is researching innovative savings products and strategies to decrease barriers to savings among low-income workers and community college students in partnership with United Way’s Free Tax Preparation Campaign and the new Housing Ready, Crisis Resilient project.

Alysha Alani is an Emerson National Hunger Fellow at United Way of King County working to ensure that King County residents are able to weather financial shocks and can work towards long-term financial stability. She is researching innovative savings products and strategies to decrease barriers to savings among low-income workers and community college students in partnership with United Way’s Free Tax Preparation Campaign and the new Housing Ready, Crisis Resilient project.

MyRA is a new savings account from the U.S. Treasury that we are proud to offer as one of three savings options at our Free Tax Preparation sites this year.

Tax time is a crucial for saving because tax refunds are often the largest lump-sum payments many taxpayers receive all year. Much of that refund may be needed to pay off bills and other immediate expenses. But setting aside a portion of it can help with financial hardships later on in the year.

In King County, the liquid asset poverty rate is 31%. This means that 31% of households do not have enough easily accessible money to survive at the poverty level for 3 months if they were to lose their main source of income.

One in 5 King County households is unbanked (no access to banking services) or underbanked (some but not full access to mainstream financial services).

One in 5 King County households is unbanked (no access to banking services) or underbanked (some but not full access to mainstream financial services).

MyRA addresses both of these gaps! Not only does it serve as a low-barrier savings account to help working families and individuals build a financial safety net in case of emergency, it is also accessible without a formal relationship with a bank or other financial institution.

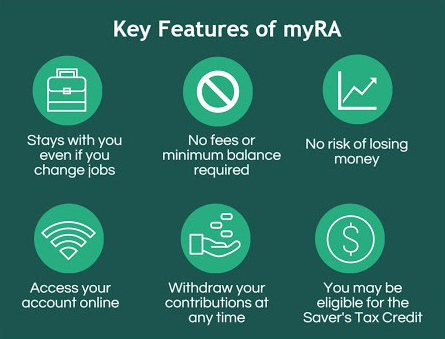

What makes myRA unique:

MyRA is a simple and safe way to build short term savings.

In January 2017, myRA accounts earned interest at 2.375%. This is higher than most savings accounts in the market. Since myRA is invested in a U.S. Treasury bond, there is no risk of losing money. You can withdraw the money you contribute to the account at any time without additional taxes or penalties. Fees will apply if you choose to withdraw interest accumulated in the account under certain circumstances.

To sign up for an account:

MyRA is available to people whose annual earned income falls below $132,000 if single, head of household, or married filing separately, or $194,000 if married filing jointly.

If you have a Social Security Number, visit the myRA website to create an account today or visit one of our 27 Free Tax Preparation sites across King County. If you have an Individual Taxpayer Identification Number (ITIN), call myRA customer service at 855-406-6972.

To sign up, you’ll need:

- Your SSN or ITIN

- An email address

- Driver’s license, state ID, U.S. passport, or military ID

- Name and date of birth of one beneficiary (person who you choose to inherit your account)

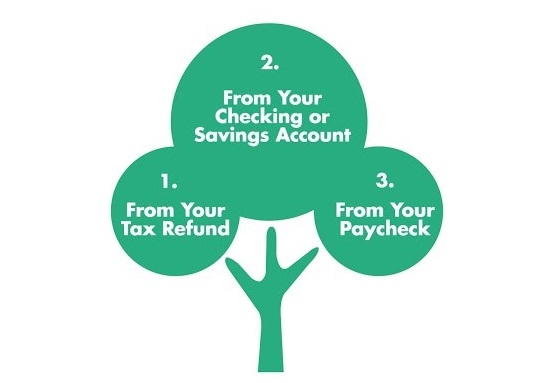

Growing your account:

Ask your tax preparer to split your refund using Form 8888. You’ll need to provide your myRA account number. After tax time, you can continue to deposit up to $5,500 a year into your myRA. $5, $50, $500—any amount helps grow your account!

From your paycheck:

You can set up automatic direct deposit to your myRA with your employer. Visit this link for a letter you can give to your employer. Click this link for the form needed to sign up for direct deposit.

From a checking or savings account:

You can set up recurring or one-time contributions to your myRA from another account, such as your bank or credit union savings or checking account.

Once your account reaches a maximum balance of $15,000 or has been active for 30 years, the balance will be transferred automatically into a private sector Roth IRA.

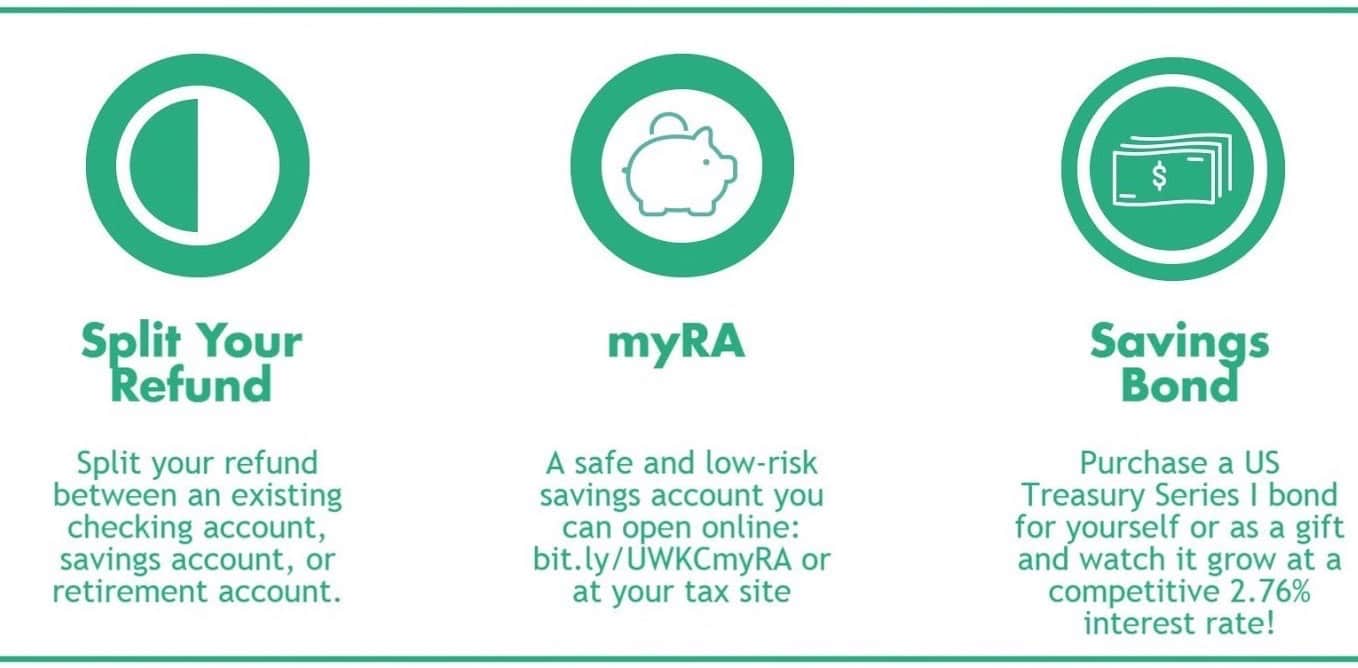

This tax season, invest in your future. Whether you choose to save in your credit union or bank account, a savings account like myRA, or by purchasing a savings bond, be sure to make your refund work for you.

To learn more about our Free Tax Preparation Campaign, including tax site locations and hours, go to freetaxexperts.org.

Comments