Need Help With Rent? See if You Qualify.

Due to limited funding, the program is not able to serve everyone that submits a Client Intake Form and submission of this form does not guarantee you will receive rental assistance.

Need Rent Help?

Have back rent and need assistance? Fill out the Client Intake Form for United Way’s Rental Assistance and Eviction Prevention Program below to check if you’re eligible.

On the List Already?

Check the status of your request.

Been Served an Eviction?

One of our partners, The Housing Justice Project, provides free legal assistance and interpreters to low-income renters (tenants) facing eviction in King County. Call them at the number below.

Questions about Rental Assistance?

Check out our FAQs or fill out our support form for additional support.

Please note that submitting this form does not guarantee assistance through this program.

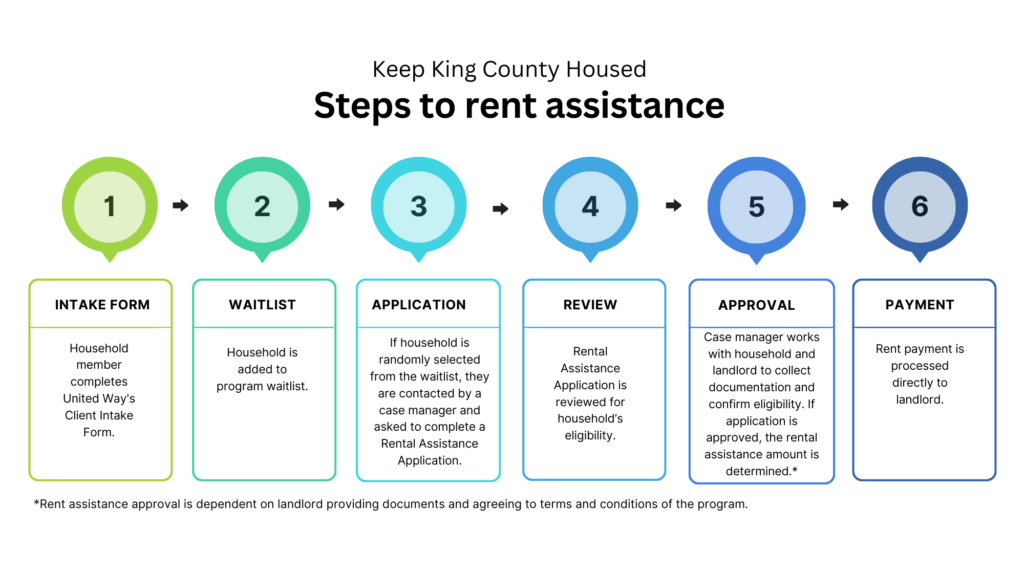

How It Works

What Our Program Does:

Provides monthly rent help to eligible households.

Eligibility Requirements:

- Current address in King County, WA.

- Household MUST reside and owe back rent at their current address.

- Household income doesn’t exceed 80% of Area Median Income (AMI).

- Landlord must be willing to participate in the program.

What Our Program Doesn’t Do:

- Help you find housing.

- Pay rent to a previous address.

- Give legal advice.

- Help with move-in costs.

Fill out a Client Intake Form.

- Don’t forget to write down your Client Intake Form record ID.

Checking your email is important!!!

- Check your email even if it’s not from United Way. One of our partner organizations could be contacting you about next steps in receiving rental assistance.

- Be sure to check your spam/junk folders to be sure these important emails aren’t missed.

- When contacting us, use the same email and phone number that you used on your Client Intake Form.

Helpful pointers and mistakes to avoid:

- Do not complete more than one Client Intake Form per household.

- Do not put your yearly income in the monthly income space.

- Check the status of your Client Intake Form.

- Read our FAQs for answers to common questions.

Check Your Client Intake Form’s Status

What Does Your Client Intake Form Status Mean?

Not Selected:

Your household has been added to the random household selection pool, but was not selected this week.

Selected households will be notified via email about their next steps. If not selected, do not complete another Client Intake Form. You will remain on the waitlist if not selected.

In Progress:

Your household was selected to apply for rental assistance and you were assigned a case manager.

If you have not completed your application (this is different from the Client Intake Form), please check your inbox and junk/spam folder for emails from your case manager or United Way.

Payment Completed:

Congratulations! Your application was approved!

Our rental assistance team has processed the payment to your landlord. Your landlord should receive their payment in 2-4 weeks.

FAQ for Renters

Have a question not covered in our FAQs? Fill out the Rental Assistance Support form below, and a member of our team will get back to you. Please note that response times may be longer than usual due to the high demand for assistance in our community.

I need assistance urgently. Can you prioritize my case?

Because our selection process is random, we are unable to prioritize case. We know you are going through a stressful time and that you need assistance as soon as possible. Unfortunately, there are a lot of renters who need assistance as soon as possible. Random selection helps us make sure we are treating all renters equitably.

PLEASE do not submit a support form ticket asking us to select you because of your situation. WE WILL NOT RESPOND TO THESE INQUIRES.

When will the application be available and how do I apply?

If you live in King County, Washington and are behind in rent, complete this Client Intake Form and we will contact you if you are selected to formally apply to receive rent assistance. At that time, we will send you information about the next steps you will have to complete to be considered for eligibility of rental assistance.

How do I know if I signed up on the Client Intake Form?

Use our Status Checker to see if you have already signed up on the Client Intake Form.

What information do I need to complete the Client Intake Form? What about the Rental Assistance Application?

The Client Intake Form and Rental Assistance Application are two separate forms. The Client Intake Form expresses your interest in receiving assistance. The Rental Assistance Application can only be completed if you have been Selected for assistance.

You will need the following information to complete the Client Intake Form:

- Your landlord/property managers name, phone number and email address.

- Basic information about your household such as your address, monthly rent amount, types of income sources and income amount.

If you have been Selected and are completing your Rental Assistance Application, you will also need to provide:

- Income documentation (such as W2s or paystubs) for every Adult (18+) household member.

- Proof of housing instability, such as a rent ledger or a 14/30-Day Notice.

- Proof of residency, such as a utility bill, renter’s insurance policy, or a government-issued ID card with your current address.

Tenants will not be required to provide a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). There are no citizenship requirements to receive assistance.

How will I know if I am chosen to receive assistance?

You will be contacted by a case manager if you are Selected to complete your Rental Assistance application. Monitor the email address and phone number you provided on your application; check your spam/junk folders.

If Selected, you will receive an two emails with the subjects:

- “Selected to Apply: Rental Assistance Program”

- “Online Connect Access”

I need help with the Connect Portal; I cannot login to complete my Rental Assistance application.

Check your email for your Connect Portal Invitation; the subject of the email is “Online Connect Access” and it contains your unique link to the Connect Portal.

Once you have created your account, you can log back in with this link: https://uwkc.socialsolutionsportal.com/login

For more help, use this Connect Portal Guide.

If you need additional help, contact your case manager.

How many months of assistance am I eligible to receive?

The amount of assistance you receive is determined by what your household owes. Our program is never able to provide more than $10,000 of rental assistance per household and you are only eligible to be selected from our program every two years, even if you move. This is due to limited funding and a high need for help. Assistance can include up to 2 months of future rent, if the renter is eligible.

What information do you need from my landlord/property manager?

Your landlord/property manager will need to provide a lease, written documentation of the charges and payments to your rental account (rent ledger) and W-9 for payment processing. Other documentation may be required as needed. This will be resolved by the case manager processing your assistance.

You do not have to contact your landlord/property manager for these documents; that is the responsibility of your case manager.

Once approved, how long will it take for my landlord/property manager to receive the payment?

Once your Rental Assistance Agreement is signed, the case is put under review before payment is processed. Payments are typically issued within 2-3 weeks after approval.

Do I have to pay this assistance back? Is it a loan?

No, rental assistance funds are provided by the federal and/or state government as a grant. They are NOT a loan and do not have to be paid back.

My landlord/property manager will not participate in this program. What can I do?

If you are selected for rental assistance and your landlord/property manager refuses to participate or refuses to accept the terms of assistance, we are not able to provide assistance. Our program requires landlords/property owners to participate in order to receive assistance.

My landlord said they are going to evict me. What should I do?

We know that communication from your landlord may be scary. No matter what your landlord says, your landlord CANNOT evict you from your unit without going through a court process (RCW 59.18.290, RCW 59.18.300). You can find more information about the eviction process, including a timeline, on the Tenants Union website.

Please call the Housing Justice project at (206) 580-0762 right away if you are served with an eviction lawsuit or summons.

An eviction “lawsuit is made up of two documents served together called the “Summons and Complaint.” They will both have numbers running down the left side of the page and the upper left-hand corner will say your name (defendant) vs. the landlord (plaintiff).”

https://tenantsunion.org/rights/eviction-processThis link will take you away from uwkc.org)

How long will it take to be selected?

We select households completely at random. There are a lot of people needing rental assistance, so we cannot tell you when you will be selected.

PLEASE do not submit a support form ticket asking when you will be selected or where you are on the list. WE WILL NOT RESPOND TO THESE INQUIRES.

I got an email that my Client Intake Form was denied but I think I still qualify. What do I do?

Completing the Intake Form screens your household for eligibility:

- Households must have a CURRENT address in King County, WA

- Households MUST reside and owe back rent at your current address

- Households at risk of homelessness:

- Households have been notified that your right to occupy current living situation will be terminated within 21 days

- Households have a missed rent payment and currently owe at least part of a rent payment (current or past)

- Household income must not exceed 80% Area Median Income (AMI) for household size

- Landlord should be willing to participate in the program

If you received an email saying your Intake Form was denied but you meet all of these requirements, please complete a Request to Update Client Intake Form.

Can I check my Rent Assistance Application or Payment status?

Yes! If you have been selected to move forward in the rental assistance process, you can login to your portal here: https://uwkc.socialsolutionsportal.com/login?redirectUrl=/

How do I update information on my Rental Assistance Application?

If you have been selected to move forward in the rental assistance process, you can login to your portal at https://uwkc.socialsolutionsportal.com/login?redirectUrl=/ to update any of your information.

If you have not been selected, you can complete a Request to Update Client Intake Form.

If selected for the rental assistance program, how will my case manager contact me?

If you are Selected to Apply for rental assistance, your case manager will contact you by phone, text, and/or email. You will be contacted by one of our trusted community partner agencies:

- Centro Cultural Mexicano – emails ending in @centroculturalmexicano.org

- Housing Justice Project – emails ending in @kcba.org

- Mary’s Place – emails ending in @marysplaceseattle.org

- Reclaiming our Greatness – emails ending in @reclaimingourgreatness.org

- ReWA – emails ending in @rewa.org

- Urban League – emails ending in @urbanleague.org

- Wellspring Family Services – emails ending in @wellspringfs.org

I received rental assistance from United Way before. Which program funding have I received in the past?

When your application was approved, we emailed you a document called the “Payment Agreement Form” or “Tenant Payment Notice.” This document will state which program funding you received.

FAQ for Landlords/Property Managers

What information do I need to provide to complete this process?

You must provide a rent ledger (or proof of payments/charges for unit), a lease and a completed W9. Other documents may be requested as needed, such as proof of property ownership, property management agreement, or a VOID Check (for Direct Deposit payments). You will also be required to sign a formal rent assistance offer once your case manager determines the tenant’s assistance amount.

*Note: We cannot accept Deposit Slips or hand-written documentation to validate your direct deposit information.

What terms are associated with accepting rent assistance through this program?

- Rent Assistance Agreement Form

- Landlord/property manager must agree to the following:

- Accept the Payment as full satisfaction of any rent balance owed for the Payment Period, including all utilities and fees.

- Charge no new late fees or additional charges for the Payment Period

- Not increase the rent for the household for the Payment Period

- Not evict, terminate or refuse to renew the above household’s tenancy until at least after the Payment Period

- For full terms and conditions, review the linked document above

Will I/why do I have to forgive any past-due rent/charges that the assistance does not cover?

As the Landlord, you are required to forgive past due rent that the assistance payment covers, called the “Payment Period” on the Rental Assistance agreement.

You are not required to forgive any rent outside of the “Payment Period” that the assistance does not cover.

Why is the payment standard less than the tenant’s monthly rent amount?

The payment standard for each unit is determined by fair market rent under HUD guidelines. This allows the program to stretch its dollars and ensure that the maximum number of tenants and landlords/property managers are served.

I signed the Rental Assistance agreement; how long will it take to receive payment?

Once the Rental Assistance Agreement is signed, the case is put under review before payment is processed. Payments are typically issued within 2-3 weeks after approval.

I received a payment, but I don’t know which tenant(s) it is for, who do I contact?

Email us at rentalpayments@uwkc.org with the Check # or payment amount.

I have a question about my steps in the process. Who do I contact?

If you have a question regarding submitting your document(s), DocuSign, or the Payment Agreement, contact your case worker directly. If you are actively involved in the assistance process, you have already been contacted by one of our trusted partner agencies:

- Centro Cultural Mexicano – emails ending in @centroculturalmexicano.org

- Housing Justice Project – emails ending in @kcba.org

- Mary’s Place – emails ending in @marysplaceseattle.org

- Reclaiming our Greatness – emails ending in @reclaimingourgreatness.org

- ReWA – emails ending in @rewa.org

- Urban League – emails ending in @urbanleague.org

Wellspring Family Services – emails ending in @wellspringfs.org

Will I have to report this income to the IRS when I file my taxes?

All rental assistance funds you receive must be reported to the IRS as income and you will receive a 1099 in the mail next tax season. If you have a question about your 1099, contact us at rentalpayments@uwkc.org.

Do you have any mortgage assistance programs/referrals?

This program is specifically for rent assistance. For mortgage resources and assistance, visit https://dfi.wa.gov/homeownership.

How do I update information on the vendor form I previously submitted?

To update your vendor information, please email rentalpayments@uwkc.org and provide a copy of the following.

- W9, must be dated and signed after January 1, 2023

- The information you need to update. We can change your:

- Contact information (name, phone, email)

- Corporate/main address

- Payment Method (Physical Check or Direct Deposit)

- Mailing address

- ACH information, a VOID check or bank letter must be provided (no deposit slips or hand-written information will be accepted)

Can I check the status of my tenant’s Rent Assistance Application?

- If your tenant has not been selected for rent assistance (or selection status is unknown), please have your tenant use our Status Checker tool for updates.

- If the application is in progress, you can reach out to the case manager for an update.

- If you have a question about an incoming payment, please email rentalpayments@uwkc.org and provide the tenant’s name and address.

FAQ for Nonprofits

How do I let clients know about the Rental Assistance Program?

We have a Rental Assistance and Eviction Prevention Help poster ready to download and share.

Need Additional Help?

From helping you file your taxes for free to resources that help tackle hunger and student success in school, let’s help you find what you’re looking for.