United is the Way We Break Generational Cycles of Poverty.

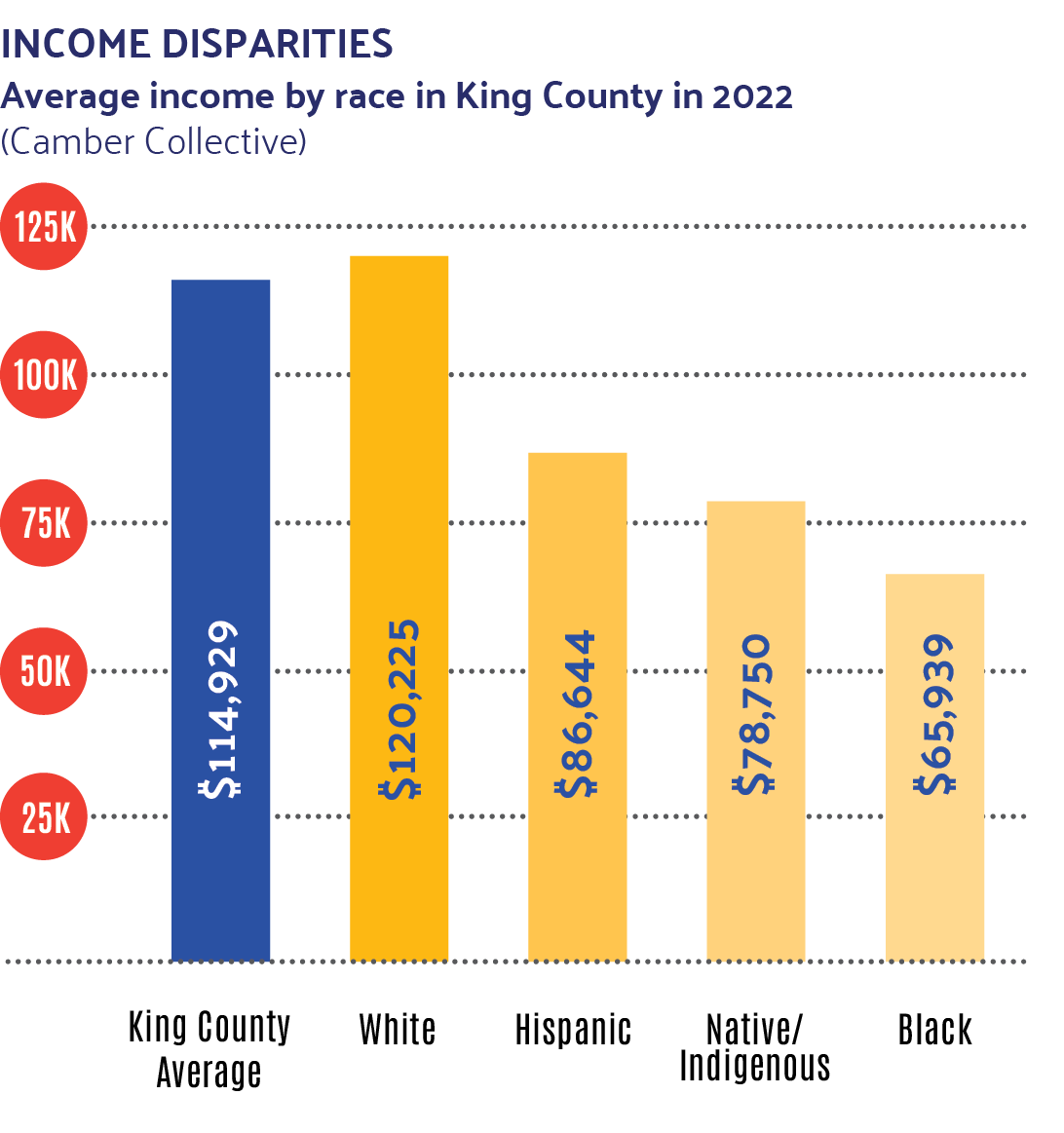

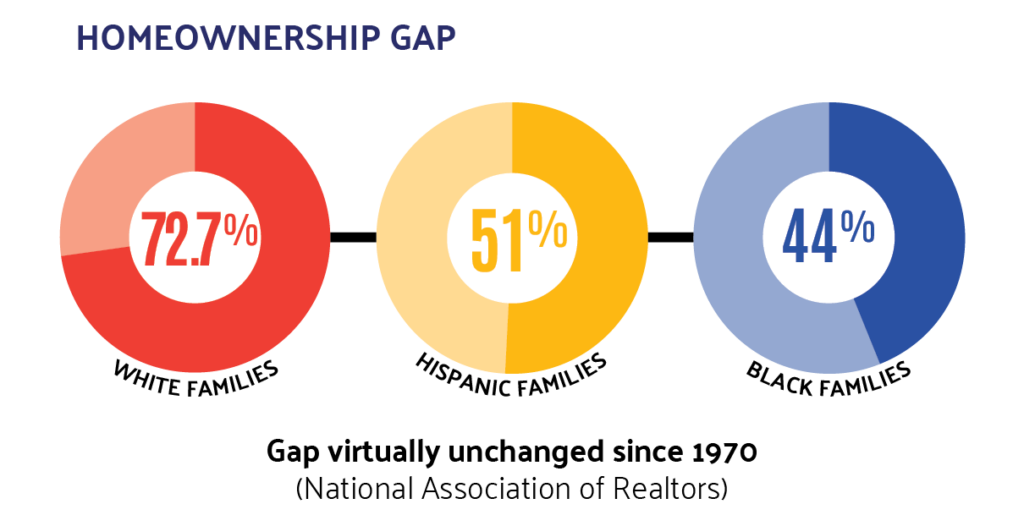

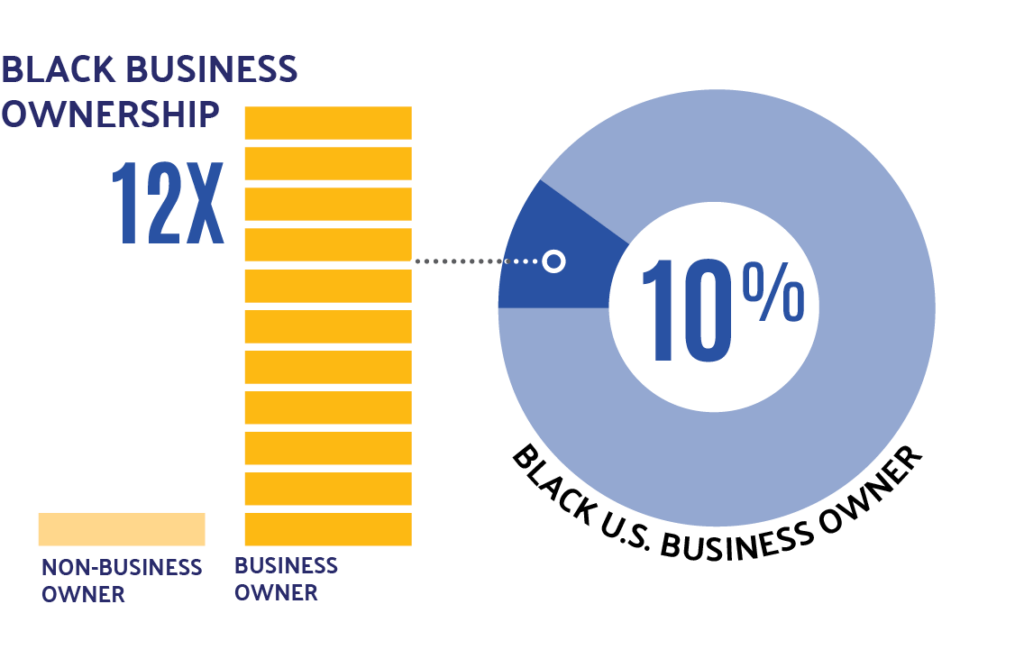

King County has a vast wealth gap—and it’s growing. Despite being one of the wealthiest regions in the nation, this gap is the direct result of centuries of discriminatory practices—like redlining, restrictive covenants, and predatory banking practices—that have denied families opportunities to build wealth.

For decades United Way of King County has worked to meet our neighbors’ immediate needs, ensuring that families have a safe place to call home and enough to eat. While we remain committed to this critical work, we’ve also seen firsthand how systemic inequities have trapped generations of our neighbors in cycles of poverty.

United Way’s Bridging the Wealth Gap Campaign is a game-changing tool to create security for our neighbors through home and business ownership.

King County’s Wealth Gap

“Homeownership is the biggest piece of generational wealth. Most Americans have built wealth off owning something—more than just equity, it’s stability. If you stabilize your housing costs, most other things get stabilized in your life. Owning something helps you grow roots and maintain them.”

– Darryl Smith, HomeSight

A REVOLUTIONARY TWO-PRONGED APPROACH

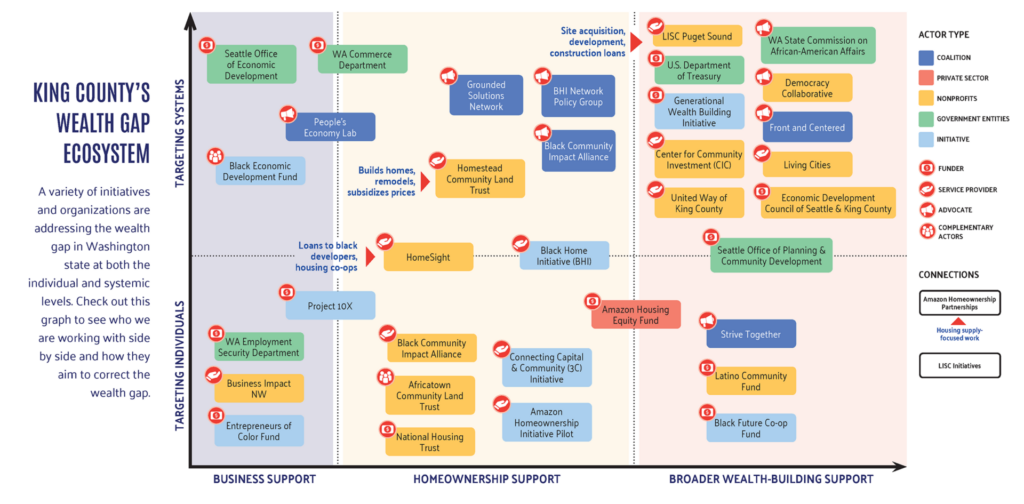

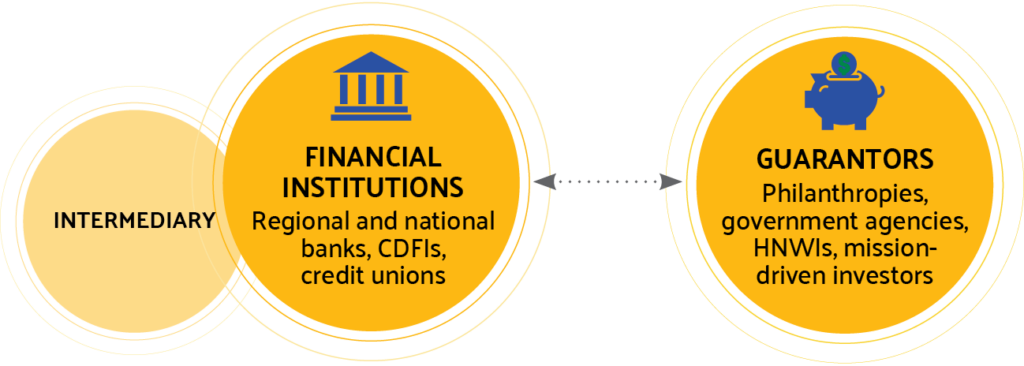

The creation of the Puget Sound Investment Guarantee Pool will reduce barriers for underserved communities in obtaining fair financing, unlocking the ability to purchase a home or launching and growing a business. Support Grants will provide funding and support to trusted nonprofit partners working in these neighborhoods, cultivating a robust ecosystem of providers that support home, and business ownership providing an economic lift to entire communities.

The Bridging the Wealth Gap Campaign will increase access to financing and capital for homeownership and small business development in communities of color across the Greater King County region for both individuals and the organizations that support them.

Puget Sound Investment Guarantee Pool

Ensure Equity

Since we will control how loans are distributed, we can prioritize families and businesses who have previously been denied access to fair lending practices.

Safety Net

The pool provides a backstop for the borrower, protecting them from potentially losing everything if they were to default on a loan.

Support Grants

To ensure that borrowers have the support they need to thrive, we’re pairing the Puget Sound Investment Guarantee Pool with Support Grants throughout the community. These grants will bolster community partners offering a range of supportive services including financial literacy, credit repair programs, loan counseling, down payment assistance, and providing business support and technical assistance.

Building generational wealth requires more than just access to capital; it requires ongoing support. Support Grants will inject additional resources into communities and increase access to the services that contribute to borrowers’ success. Together the Puget Sound Investment Guarantee Pool and Support Grants offer a collaborative effort in addressing systemic barriers to wealth creation.